What is an Audited Financial Statement ?

An audited financial statement is a formal record of a company’s financial activities that has been examined and verified by an independent certified public accountant (CPA). The purpose of an audit is to provide assurance that the financial statements are free from material misstatement and are presented fairly in accordance with applicable accounting standards.

Understanding what an audited financial statement is and recognizing its importance can greatly enhance how a business is perceived and operates within its market.

Understanding what an audited financial statement is and recognizing its importance can greatly enhance how a business is perceived and operates within its market.

What Is an Audited Financial Statement?

An audited financial statement typically includes the following components:

- Balance Sheet: Shows the company’s assets, liabilities, and equity as of the statement date.

- Income Statement: Also known as the profit and loss statement, it shows the company’s revenues, expenses, and profits over a specific period.

- Cash Flow Statement: Details the flows of cash in and out of the business over the reporting period.

- Statement of Changes in Equity: Shows changes in the ownership interest in the company.

Along with these financial statements, an auditor’s report is also provided, which expresses the auditor’s opinion on the financial statements.

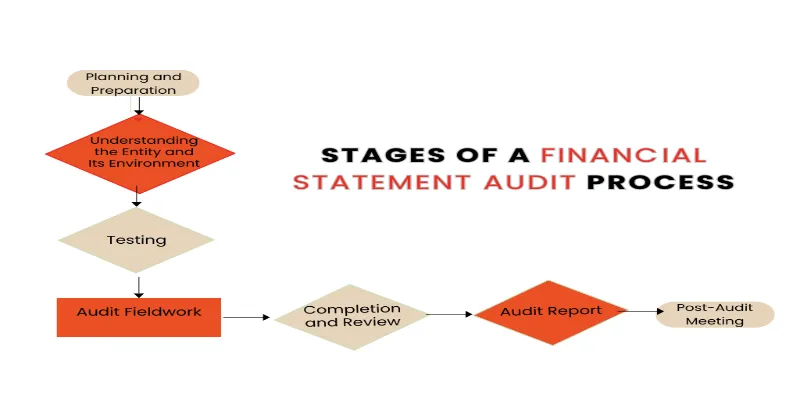

Stages of a Financial Statement Audit Process

The process of conducting a financial statement audit is methodical and detailed, encompassing several critical stages to ensure the accuracy and reliability of the financial statements.

1: Planning and Preparation

The audit begins with the planning and preparation phase, where the auditing team is engaged and the terms of the audit are set forth in an engagement letter. The audit team is carefully selected based on their expertise and the specific needs of the audit. During this stage, auditors perform a risk assessment to identify potential areas of concern that could impact the financial statements. This involves understanding the company’s business environment and internal controls to determine the scope and nature of the audit procedures to be performed.

2: Understanding the Entity and Its Environment

In this phase, auditors gain a deeper understanding of the entity’s operations and the environment in which it operates. They evaluate the effectiveness of the entity’s internal controls and perform analytical procedures to identify unusual transactions or events that may require further investigation. This helps in focusing the audit efforts on areas of higher risk.

3: Testing

Testing is a core component of the audit process. It includes the testing of controls to ensure they are operating effectively throughout the period under review. If the controls are found to be reliable, auditors may decide to rely on them for certain aspects of the audit. Additionally, substantive testing of transactions and account balances is performed to verify the accuracy of the information recorded in the financial statements.

4: Audit Fieldwork

During the fieldwork stage, auditors collect and analyze evidence through various methods such as observation, inspection, confirmation, and calculation. This evidence is crucial in supporting the auditors’ conclusions about the accuracy and fairness of the financial reporting. All findings and evidence are meticulously documented in audit workpapers, which serve as a record of the audit process and findings.

5: Completion and Review

As the audit nears completion, a final analytical review of the financial statements is conducted to ensure consistency and logical presentation. The audit work undergoes a thorough review by senior auditors and partners to ensure compliance with auditing standards and the overall quality of the audit. This stage is critical for finalizing the findings and preparing for the audit report.

6: Audit Report

The culmination of the audit process is the drafting and issuance of the audit report. This report provides the auditor’s opinion on whether the financial statements are presented fairly, in all material respects, in accordance with the applicable financial reporting framework. Prior to issuing the final report, significant findings are discussed with management to ensure clarity and resolution of any outstanding issues.

7: Post-Audit Meeting</h4>

After the audit report is issued, a post-audit meeting is often held with the client. This meeting is an opportunity to discuss the audit findings in detail, address any difficulties encountered during the audit process, and suggest areas for improvement. This final stage helps in closing the current audit and setting the stage for future audits, ensuring ongoing communication and understanding between the auditor and the client.

Each of these stages is integral to the overall effectiveness of the audit, ensuring that stakeholders can rely on the financial statements for making informed decisions.

Reasons Why You Need an Audited Financial Statement

Having an audited financial statement is critical for businesses of all sizes, across various industries. Here are some compelling reasons why obtaining an audited financial statement is essential:

- Enhancing Credibility: Audited financial statements provide stakeholders (like investors, lenders, and suppliers) with enhanced confidence in the financial integrity of a company.

- Regulatory Compliance: Many companies are legally required to submit audited financial statements. For example, public companies must file them with the Securities and Exchange Commission (SEC) to comply with regulations.

- Facilitating Financing: Banks and financial institutions often require audited financial statements as part of the loan approval process to assess the creditworthiness of a business.

- Improving Internal Controls: The audit process can identify weaknesses in a company’s internal controls, leading to improved systems and procedures that help prevent fraud and errors.

- Attracting Investors: Potential investors often require audited financial statements to assess the health and viability of a business before committing their capital.

- Tax Compliance: Audited statements can help ensure that all financial information has been accounted for and reported correctly for tax purposes, potentially reducing the likelihood of problems with tax authorities.

- Performance Assessment: They provide a reliable basis for evaluating the performance of a company, which is essential for management, investors, and other stakeholders in making informed decisions.

- Operational Improvements: The insights gained from an audit can inform management about various aspects of the business that could be optimized to enhance profitability and efficiency.

- Corporate Governance: For corporations, particularly those with diverse and widespread ownership, audited financial statements are a cornerstone of good governance, ensuring that the management is accurately reporting the financial status of the company to its shareholders.

- Succession Planning: In businesses planning for succession, audited statements provide a clear, objective assessment of the business’s value and financial health, which is crucial for both selling the business and ensuring it continues smoothly under new leadership.

The need for and benefits of audited financial statements can vary significantly depending on the specific circumstances and requirements of the business. However, for many organizations, particularly those seeking growth or operating in regulated industries, having regular audits is a critical aspect of their financial oversight and strategic planning.

Enhance Business Integrity with Audited Financial Statements

Audited financial statements are not just a regulatory formality; they are a fundamental aspect of business governance that enhances financial transparency and stakeholder trust. Whether you are seeking to attract investment, secure financing, or simply maintain rigorous financial oversight, the insights gained from an audit can prove invaluable. For expert guidance through this process, consider consulting with professional Tax Consultants. Embrace the auditing process as a vital tool for illuminating your company’s financial health and paving the way for sustained success and growth.

Frequently Asked Questions

1: Who Needs an Audited Financial Statement?

Public companies are required by law to provide audited financial statements. Private companies may need them when seeking loans, attracting investors, or engaging in significant business transactions. Nonprofits and some small businesses may also need audits depending on their size, grant requirements, or lender stipulations.

2: What are the different types of audit opinions?

There are four main types of audit opinions that an auditor might issue based on their findings:

- Unqualified Opinion (Clean Opinion): The financial statements are presented fairly and in accordance with the relevant accounting standards.

- Qualified Opinion: There are specific issues with the financial statements, but they do not misrepresent the overall financial condition of the company.

- Adverse Opinion: The financial statements contain significant misrepresentation and should not be considered reliable or accurate.

- Disclaimer of Opinion: The auditor could not obtain sufficient information to form an opinion on the financial statements.

3: What Happens if an Audit Results in a Negative Opinion?

A negative audit opinion indicates that there are significant misstatements in the financial statements. This can lead to a loss of trust among stakeholders, potential legal issues, and difficulties in securing funding. Companies usually must address the issues identified and may need to restate their financials after correcting inaccuracies.

4: Can a company perform its own audit?

No, an audit must be performed by an independent external auditor or audit firm. This independence ensures that the audit opinion is unbiased and reliable, which is critical for maintaining the credibility of the financial statements.

5: What are the consequences of not having audited financial statements?

Companies that fail to have their financial statements audited when required may face legal penalties, loss of investor confidence, difficulties in raising funds, and potential issues with creditors. Additionally, without audited financials, a company may struggle to assess its financial health accurately.