Complete Guide to PTCL Tax Certificate: Everything You Need to Know

Ever found yourself digging through tax documents and scratching your head over how to obtain your PTCL tax certificate in Pakistan? Maybe it’s tax season, and you’re trying to get your financial affairs in order, but this particular document is proving to be a challenge. Tax matters can be complicated, especially in Pakistan, but there’s a way to simplify this process. This guide is designed for individuals like you who want a hassle-free approach to acquiring their PTCL tax certificate. Keep reading, and by the end of this blog, you’ll be fully equipped to handle this with ease.

Brief Overview of PTCL (Pakistan Telecommunication Company Limited)

Pakistan Telecommunication Company Limited (PTCL) stands as the primary telecommunication authority in Pakistan. With its roots tracing back to the pre-independence era, PTCL has evolved into a modern, tech-savvy corporation catering to millions across the country.As with any major service provider, PTCL is under the obligation to maintain transparency in its financial dealings. The tax document stands as a beacon of this commitment, ensuring every rupee’s accountability.A PTCL Tax page is paramount for:

- Proof of tax deductions related to PTCL services.

- Filing annual income tax returns.

- Transparent financial and tax record maintenance.

Requirements For Acquiring The Tax Certification

| Requirement | Description |

|---|---|

| Authentic ID Card (CNIC) | For identity verification. |

| Recent PTCL Bill | To confirm you’re an active PTCL subscriber. |

| Proof of Past Payments | Validates your financial integrity with PTCL. |

Once your application is submitted, PTCL doesn’t simply stamp it approved. A meticulous verification ensures that your records align with PTCL’s databases.

A Step-by-Step Guide To Getting Your PTCL Withholding Invoice

Step 1: Access the Official PTCL Website https://ptcl.com.pk/CustomerTax/TaxInquiry

Firstly, open your preferred web browser and type in the URL or simply click on: Official PTCL Website. This will lead you directly to the Tax document inquiry page of PTCL.

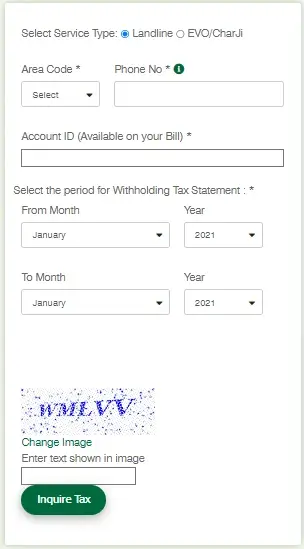

Step 2: Choose Your Service Type

Upon landing on the webpage, you’ll notice a dropdown menu titled ‘Service Type.’ Click on this menu and select ‘Landline’ from the available options.

Step 3: Input the PTCL Area Code

Below the service type, there’s another dropdown menu for ‘Area Code.’ Select your specific PTCL area code from the dropdown list. For example, if you’re from Karachi, you’ll choose ‘021.’

Step 4: Enter Your Phone Number

In the next input box, type in your complete PTCL phone number. It should follow this format: 021-1234567890. Ensure that you include the hyphen after the area code.

Step 5: Input the Account ID

This is a crucial step. You’ll need to enter the specific Account ID associated with your PTCL number. This ID is usually found on your monthly PTCL bill. It’s a unique number provided by PTCL to each customer.

Step 6: Select the Desired Period

You’ll notice an option titled ‘Period.’ Click on it to select the timeframe for which you want the tax document. This could be monthly, quarterly, or annually, depending on your preference.

Step 7: Solve the Captcha

For security purposes, there’s a captcha box. This is to ensure that the request is being made by a human and not by automated bots. Follow the captcha instructions and input the characters or numbers you see in the provided box.

Step 8: Initiate the Inquiry

Once all details are correctly filled in, click on the ‘Inquire Tax’ button. The system will then process your request.

Step 9: Download Your Tax Document

If all the details match PTCL’s records, you’ll be redirected to a new page. Here, your PTCL Tax document will be displayed, ready for download. Click on the ‘Download’ or ‘Print’ button to save the certificate on your device or print it out.

Why Do You Need a PTCL Tax Document?

This certificate isn’t a mere piece of paper. It’s proof! It assures you and others that you’ve fulfilled all your financial obligations related to PTCL. Crucial for:

- Ensuring smooth tax returns.

- Keeping your business operations transparent.

- Garnering trust during financial dealings, such as loan acquisitions.

Common Mistakes To Avoid

A Stitch in Time : Delaying your application? This is the first pitfall. Mark your calendar, set reminders but avoid procrastination.

Details, Details, Details! : Input errors, a mismatch of details, or outdated information? These can be roadblocks. Double, even triple-check your inputs.

Renewal Woes : Tax documents have a shelf-life. Overlooking renewal deadlines could land you in hot water. Stay ahead.

The Validity And Duration Of The PTCL Tax Document

| Topic | Details |

|---|---|

| Validity Period | Annual – Typically covers one fiscal year. |

| Importance of Specific Dates | Always refer to the “valid from” and “valid to” dates on the certificate. |

| Reason for Set Duration | Ensures tax records are up-to-date, reflecting the most recent payments and deductions. |

| When to Renew | As the certificate approaches its expiration. Renew close to the expiration date for a continuous record. |

| Utility | Handy during tax filing seasons and for official financial verifications. |

Tips for Safe Storage of Your PTCL Tax Proofs

In the realm of financial accountability and taxation, the significance of proper documentation cannot be overstated. Among these essential documents for residents of Pakistan is the PTCL Tax Certificate. This isn’t just a routine piece of paper—it’s a safeguard against potential legal and financial challenges. Let’s explore the crucial repercussions of not maintaining this vital document and why it’s essential for your financial well-being.

Legal Disputes with Tax Authorities

Without a PTCL Tax Certificate, you might find yourself on shaky ground with the tax authorities. This document serves as proof that you’ve met your telecommunication tax obligations. Its absence could raise suspicions, leading to unwanted legal scrutiny or disputes. Such legal entanglements can be both resource-draining and time-consuming, making it crucial to have this certification on hand to avoid unnecessary complications.

Potential Fines or Penalties

In the world of taxation, missing documentation can lead to significant consequences. If you cannot produce a PTCL Tax Certificate when required, you might face substantial fines or penalties. Authorities may assume the absence of this certificate indicates unaccounted tax liabilities, prompting punitive measures. To avoid these financial setbacks, ensure you have your PTCL Tax Certificate readily available and properly stored.

Challenges During Tax Consultations

Imagine discussing your finances with a tax consultant, and the topic of telecommunication tax surfaces. If you lack the PTCL Tax Certificate, your consultant might struggle to verify your tax history accurately. This can hinder the efficiency of the consultation process and cast doubts on your financial transparency. Keeping your PTCL Tax Certificate organized and accessible can streamline tax consultations, ensuring a smooth and transparent process.

How to Store Your PTCL Tax Proofs Safely

Proper storage of your PTCL Tax Certificate is essential for maintaining financial order and compliance. Here are some practical tips:

- Digital Backup: Scan and save a digital copy of your PTCL Tax Certificate in a secure, cloud-based storage solution.

- Physical Storage: Store the physical certificate in a safe place, such as a dedicated folder for important financial documents.

- Regular Updates: Periodically update your records and ensure the certificate is still valid and correctly reflects your tax payments.

- Consult a Professional: For personalized advice on storing and managing your tax documents, consider consulting with a tax professional.

Conclusion

Navigating the complexities of taxation in Pakistan requires careful attention to documentation, and the PTCL Tax Certificate plays a crucial role in this process. Beyond legal compliance, this certificate promotes financial transparency and ease. With the right documentation and guidance from tax consultancy experts, managing your tax obligations becomes significantly smoother. Use this guide as a reference to ensure your financial journey remains clear and stress-free. Embrace the advantages of well-maintained tax documentation, and secure your path to financial transparency!