How To File A Sales Tax Return In Pakistan ?

In Pakistan, there’s a simple rule: if you sell goods, you deal with sales tax—a cost usually passed to buyers. It’s a key piece of our economy, helping fund everything from roads to schools. The 18th Amendment lets provinces handle service taxes, but sales tax on goods? That’s the federal game, run by the FBR since the 1990 Sales Tax Act. Every seller, big or small, must file a Sales Tax Return—essentially a report card of their sales—and pay up. It’s not just paperwork; it’s how you contribute to our nation’s growth, one sale at a time.

At “Khan & Co”, we grasp the importance of getting it right the first sail. Join us as we guide you through the swift currents of compliance, empowering you to anchor your business in the safe harbour of fiscal prudence.

Who Is Necessary In Order To Be Registered Under Sales Tax Act 1990?

Under the Sales Tax Act of 1990 in Pakistan, registration is a must for:

- Manufacturers: If you’re crafting goods, you’re on the list.

- Importers and Exporters: Crossing borders with goods? You need to register.

- Wholesalers & Distributors: Bulk sellers and supply chain champs, take note.

- Retailers: Running a shop? If your annual sales hit the FBR’s set limit, sign up.

- Service Providers: Only if you deal in goods along with services.

- Online Businesses: Selling goods online? The digital marketplace demands your registration too.

Stay sharp! Registering means you’re in the clear to do business and keeps you away from penalties as well as from sales tax rate. It’s not just a formality; it’s your badge as a legit player in Pakistan’s market game.

List Of Documents Required For Registration Under Sales Tax Act 1990?

Here’s a concise and reader-friendly table listing the documents required for registration under the Sales Tax Act of 1990:

| Document Type | Description |

|---|---|

| National Tax Number (NTN) | Your tax identity’s heartbeat |

| CNIC Copy | Your national identity’s mirror |

| Bank Account Proof | A snapshot of your business transactions |

| Business Address Evidence | The physical footprint of your commercial space |

| Utility Bill of Business Premise | The pulse of your workspace’s utilities |

| Registration Certificate (if applicable) | Your business’s birth certificate |

| Latest Financial Statements | The financial story of your business’s journey |

| Sales Tax Invoices (if any) | Previous sales tales, if they were told |

Getting these papers in order is like packing for a trek—you want to be prepared for the journey ahead in the market’s landscape. Think of each document as a checkpoint, ensuring you’re on the path to compliance and success.

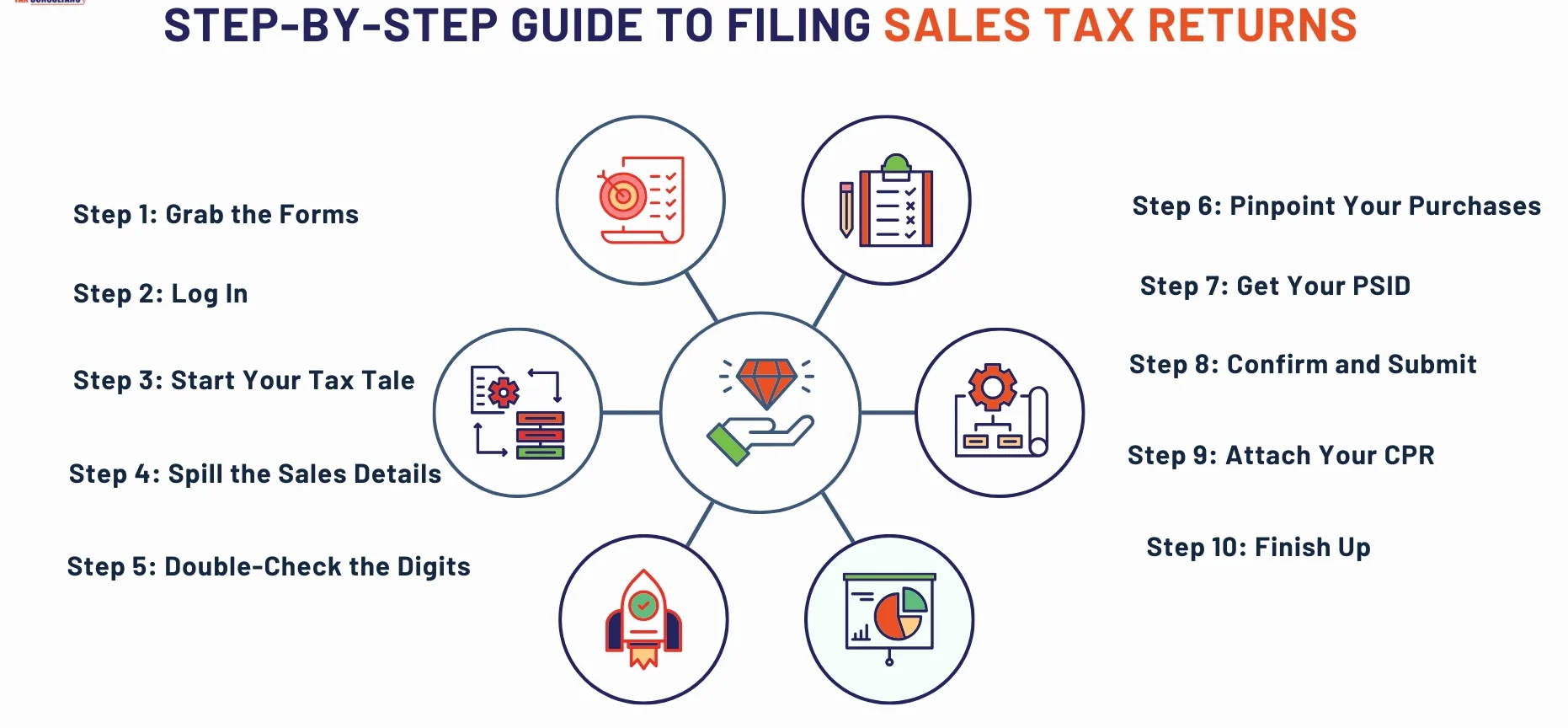

Step-by-Step Guide To Filing Sales Tax Returns

Step 1: Grab the Forms

Hop onto the FBR website and pick up the sales tax return forms. Think of these as your ticket to the sales tax show.

Step 2: Log In

Use your company’s FBR details to log in. It’s like unlocking your digital diary of tax affairs.

Step 3: Start Your Tax Tale

Hit ‘Declaration’ and choose your tax month, like setting the date for an important meetup.

Step 4: Spill the Sales Details

Jump into Annexure C. Here you’ll list your sales, just like noting down your daily sales at the shop.

Step 5: Double-Check the Digits

Scan your sales data. It’s like rechecking your change after a purchase—accuracy matters.

Step 6: Pinpoint Your Purchases

Head to Annexure A and pick out your purchases. It’s like circling dates on a calendar—mark the right ones.

Step 7: Get Your PSID

Go to e.fbr.gov.pk and grab a PSID. It’s your payment slip for the tax payment, like a bus ticket for your cash.

Step 8: Confirm and Submit

With your PSID in hand, go back, submit Annexure C, and give it the final nod. It’s as important as sealing your letter.

Step 9: Attach Your CPR

Now, attach your CPR—the official stamp on your tax document, proving you’ve paid your dues.

Step 10: Finish Up

Click ‘Process & Submit’ to send off your tax return. You’ve just wrapped up your fiscal responsibility with a neat bow.

Pro Tips:

Keep your bills and slips tidy and tracked. It’s like keeping your spices sorted—you’ll find what you need without a hassle.

Know your tax rates like you know your recipes—a pinch wrong can spoil the dish. If it’s tricky, don’t shy away from asking a tax guru. It’s like asking for directions—you’ll get to your destination smoother and faster.

Paying Your Dues: The Sales Tax Saga

When it’s time to settle your sales tax in Pakistan, you’ve got options. Let’s break it down:

Online, Anytime:

Tap into the digital age by using the FBR’s e-payment portal. Here’s how you roll:

- Log into your FBR account.

- Generate your unique PSID for the sales tax amount due.

- Use online banking, ATM, or the nearest bank branch to pay using that PSID.

Think of it as recharging your mobile credit—quick and digital.

Offline, Traditional Track:

More of a paper-and-pen person? No problem.

- Write a cheque or grab a pay order.

- March to your bank with your PSID.

- Hand it over and get a receipt, like buying a ticket to a cricket match.

Refunds: The Return Journey

Overpaid? Your money’s not gone for a toss.

- File your refund claim through the FBR portal. Fill out the form like you’re ordering your favourite biryani—detail is key.

- Attach all necessary docs—think of them as ingredients for a perfect refund recipe.

- Submit and track. Stay updated, like checking your order status.

Timeliness: Beat the Clock

Time is money, and with taxes, it’s literal.

- Pay on time, like catching the bus before it leaves.

- File refunds without delay, like returning a misfit shirt to get the right size.

Slip up, and penalties wave at you, like a traffic warden with a ticket.

Remember, in the tax world, timing is not just punctuality, it’s savings and peace of mind. Keep it timely, keep it tidy!

Conclusion

In wrapping up, acing your sales tax return in Pakistan is a dance of diligence. Whether you’re a marketplace vip or a corner shop captain, staying sharp with your tax returns fortifies your business against fiscal hiccups. It’s about keeping your commerce car steered straight on the road of regulations. Time is your co-pilot; file swiftly to dodge any late-filing squalls. Remember, it’s not just about filling forms but fueling the nation’s progress. Consult, compute, and contribute—your timely tax triumphs weave into Pakistan’s thriving economic tapestry. Keep it savvy, keep it straightforward, and let’s grow together!

FAQs: Your Sales Tax Guidebook

1. What’s a Sales Tax Return?

Think of it as a report card, showing all the sales tax you collected and paid. It’s like telling the government, “Here’s what I earned, and here’s the tax I’ve handled.”

2. Who should file a Sales Tax Return?

If you’re in the business game, selling goods or offering services, and you’re registered for Sales Tax, you need to file it. It’s like having a licence to drive on the business roads.

3. When do I file my Sales Tax Return?

Every month has its own tax tale. You’ve got until the 18th of the following month to file your return. Mark your calendars; it’s as important as remembering a family birthday!

4. Can I file my Sales Tax Return online?

Absolutely! It’s 2023, after all. The FBR’s e-filing system is your go-to. It’s like online shopping, but instead, you’re checking out with your tax details.

5. What if I miss the deadline?

Haste is the key! Missing the deadline can lead to fines—it’s like arriving late to a wedding and finding all the biryani gone.