How To Register For Indirect Tax ? Full Guide

The term “indirect tax,” which is frequently used in the business sector, describes taxes that are imposed on goods and services as opposed to income or profits. This covers sales tax, value-added tax, and goods and services tax (GST) in Pakistan. Understanding these taxes are important for business owners because they affect how much consumers must pay for goods and services. Businesses must legally register for indirect taxes in order to ensure compliance with national tax laws and to avoid possible penalties. This guide by Khan & Co aims to streamline the indirect tax registration process for new and existing businesses across multiple industries. You’ll be more capable of navigating the complexities of tax compliance in Pakistan if you adhere to our simple instructions and case studies.

Eligibility Criteria For Indirect Tax Registration

Not all businesses in Pakistan are required to immediately register for indirect taxes. To decide who needs to register, the Federal Board of Revenue (FBR) establishes particular benchmarks and requirements. Understanding these rules is the first step to making sure your business follows the country’s tax laws.

Who Needs To Register?

| Category | Criteria | Threshold/Remarks |

|---|---|---|

| Sales Tax on Goods | Manufacture or sale of goods with annual turnover above a certain threshold; Importers and exporters of taxable goods. | Varies (e.g., PKR 10 million for goods, subject to change). |

| Sales Tax on Services | Service providers with annual revenue above the FBR-set threshold. | Varies by province for services; check provincial regulations. |

| Federal Excise Duty (FED) | Businesses dealing in goods or services subject to FED. | Applies regardless of turnover; specific goods and services listed by FBR. |

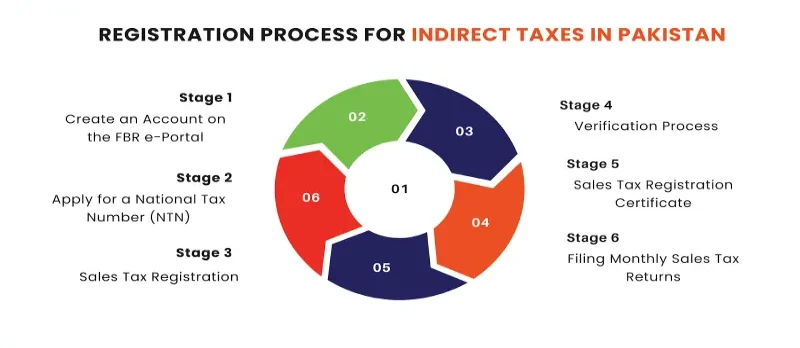

Step-by-Step Registration Process For Indirect Taxes In Pakistan

Step 1: Create an Account on the FBR e-Portal

- Visit the official FBR website and locate the e-portal for registration, known as ‘IRIS’.

- You’ll need to provide basic information such as your name, CNIC (Computerised National Identity Card) number, cell phone number, and email address. This creates your account, which you’ll use for all future tax-related activities.

Step 2: Apply for a National Tax Number (NTN)

- Once logged in, navigate to the registration section and select the option to apply for an NTN number.

- Fill in the required fields, including personal, business, and contact information. You will need to upload necessary documents, such as a CNIC copy, business proof (e.g., utility bill with business address), and any other documentation specified by the FBR.

Step 3: Sales Tax Registration

- After obtaining your NTN, you can proceed with sales tax registration.

- In the IRIS portal, find the sales tax registration form. Complete it by providing detailed information about your business activities, bank account details, and the types of goods or services you deal in. Attach required documents, which may include a business bank account certificate, ownership proof or rental agreement of the business premises, and any licences specific to your business sector.

Step 4: Verification Process

- Submit the application and await verification.

- The FBR may conduct a physical verification of your business premises as part of the registration process. Be prepared to provide additional information or clarification if requested by the verification team.

Step 5: Sales Tax Registration Certificate

- Once verified, you will be issued a Sales Tax Registration Number (STRN).

- You can download the Sales Tax Registration Certificate from the IRIS portal. This certificate is proof of your registration and should be displayed prominently at your place of business.

Step 6: Filing Monthly Sales Tax Returns

- Registered businesses are required to file monthly sales tax returns.

- Use the FBR e-portal to submit your sales tax returns by the due date each month. The process involves reporting your sales, purchases, and calculating the tax due or refundable based on your input and output tax.

After Registration – What Next?

Managing your Sales Tax Registration Certificate and consistently filing monthly sales tax returns become your two main responsibilities after you’ve successfully completed the registration process and your company has been granted official recognition for indirect taxes by Pakistan’s Federal Board of Revenue (FBR). With a clear methodology and practical examples, let us dissect what these mean.

Issuance of Sales Tax Registration Certificate

The Sales Tax Registration Certificate is a concrete document attesting to your company’s compliance with Pakistani tax regulations and granting you the right to file a sales tax on products and services. Consider it a symbol of legitimacy and trustworthiness, providing reassurance to suppliers and clients about the legitimacy and transparency of your company’s operations.

At your place of business, this certificate needs to be prominently displayed. Imagine entering a tiny cafe in Islamabad and noticing their Sales Tax Registration Certificate framed on the wall next to the entrance. This not only increases client confidence but also makes sure that your company complies with the law in a visible way, which may lower the possibility of fines or other legal issues.

Monthly Sales Tax Filing

Monthly sales tax returns must be filed by businesses following registration. To do this, you must report all taxable sales and purchases, figure out the types of taxes that are collected from consumers, and deduct the tax that you have paid on purchases made for your company. What you owe the government and, in certain situations, what the government owes you in the form of a refund make up the difference.For various reasons, filing on a regular basis and checking tax filer status is essential. Maintaining compliance with tax laws, preventing penalties, and being able to recover overpaid taxes are all benefits of it. Consider that you are the owner of a Lahore bookstore. The sales tax on the books you sell is what you collect each month. On books you buy from suppliers, you also pay sales tax at the same time. You supply the FBR with these amounts by filing your monthly returns. The government will be entitled to any excess tax revenue that you have collected over your payments. You could get a refund if it’s less.

Keeping a thorough journal of your company’s sales tax-related financial transactions is similar to filing your tax returns Similar to how keeping a journal helps you recall significant occasions, filing taxes on a regular basis keeps you aware of your financial responsibilities and rights, ensuring that your company stays solvent and complies with the law.

Conclusion

Complying with indirect tax registration is essential for every business operating in Pakistan. It’s not just a legal requirement but a step towards establishing trust and credibility in the market. This guide has simplified the registration process to ensure you can navigate it smoothly. However, encountering complexities is natural. In such cases, seeking professional advice from tax consultancy is crucial to avoid missteps and ensure compliance. Keep in mind, following tax rules protects your business from fines and helps it grow steadily. As we keep building our businesses, let’s focus on being open and responsible.

Frequently Asked Questions

1. What happens if I don’t register for indirect taxes on time?

If you don’t register on time, you might have to pay fines or face other legal actions from the FBR.

2. Can I deregister for indirect taxes if I close my business?

Yes, if you close your business or your turnover falls below the required threshold, you can apply for deregistration through the FBR portal.

3. Is there a cost to register for indirect taxes?

Registering for indirect taxes is usually free, but there could be costs related to getting professional help if you need it.

4. How long does the registration process take?

The time can vary, but once all documents are submitted, it usually takes a few weeks for the FBR to process your registration.

5. Will I receive a physical copy of the Sales Tax Registration Certificate?

No, the FBR issues digital certificates, which you can print and display in your business premises.

6. If I run an online business, do I still need to display the Sales Tax Registration Certificate?

For an online business, it’s recommended to display your registration number on your website and any invoices you issue.

7. Can I charge sales tax before my registration is completed?

No, you should not charge sales tax until your registration is confirmed and you have received your Sales Tax Registration Number (STRN).