How To Register A Software House In Pakistan ?

Starting a software house in Pakistan is an exciting opportunity in today’s fast-growing IT sector. With the industry booming and an increasing demand for innovative tech solutions, there’s never been a better time to dive into the software business. This blog post by tax consultancy is designed as a comprehensive guide for aspiring software house owners, providing you with all the necessary steps and legal requirements to get your business off the ground. From understanding the regulatory framework to taking advantage of the current tax incentives, we’ll cover everything you need to know to establish a successful software house in Pakistan.

Selecting The Right Business Structure For Your Software House

The right business structure is essential when starting a software house in Pakistan. The type of business entity you choose can significantly affect your daily operations, taxes, and personal liability. Here are the most common business structures you can consider:

Sole Proprietorship

| Advantages | Disadvantages |

|---|---|

| Simplest and least costly option to establish. | The owner is personally liable for all business debts and obligations. |

| Owner maintains complete control of the business. | Limited capacity for raising funds. |

| Fewer formalities and lower regulatory burdens. |

Partnership

| Advantages | Disadvantages |

|---|---|

| Easy to establish with minimal paperwork. | Partners are jointly and severally liable for business debts and obligations. |

| Shared responsibility can lead to increased capacity for raising funds and diversified skills. | Potential for disputes among partners over business decisions. |

Limited Liability Company (LLC)

| Advantages | Disadvantages |

|---|---|

| Owners have limited personal liability for business debts. | More complex to set up and operate than a sole proprietorship or partnership. |

| More flexibility in management and distribution of profits. | Subject to more regulations and higher initial costs. |

| Perceived as a more professional/credible structure by clients and investors. |

Each of these structures has its benefits and drawbacks, and the best choice depends on your specific circumstances, such as your risk tolerance, business goals, and financial situation. Understanding these options will help you make an informed decision about the foundation of your software house company and set the stage for its future growth and success.

By carefully considering these structures, you can choose the one that best fits the needs of your burgeoning software house, aligning with your strategic business goals and personal liability comfort level.

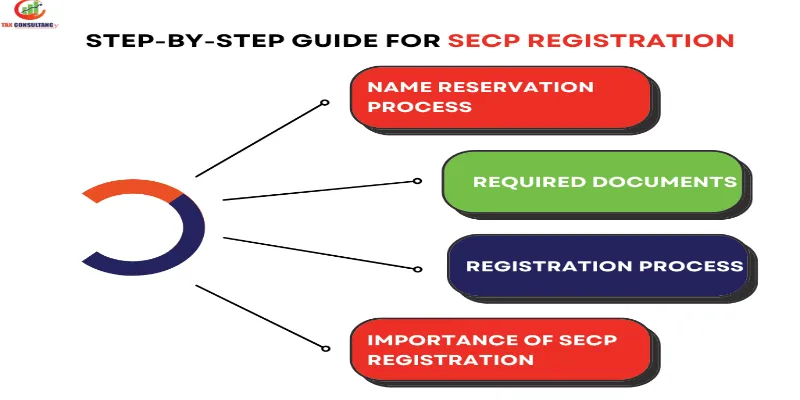

Registration With SECP (Mandatory)

Registering your software house with the Securities and Exchange Commission of Pakistan (SECP) is critical in establishing your business’s legal credibility and operational capability. Here’s why it’s important and how you can go about it:

1. Name Reservation Process

- Submit a name reservation application through SECP’s eServices portal.

- Ensure the name is not already taken or similar to existing companies.

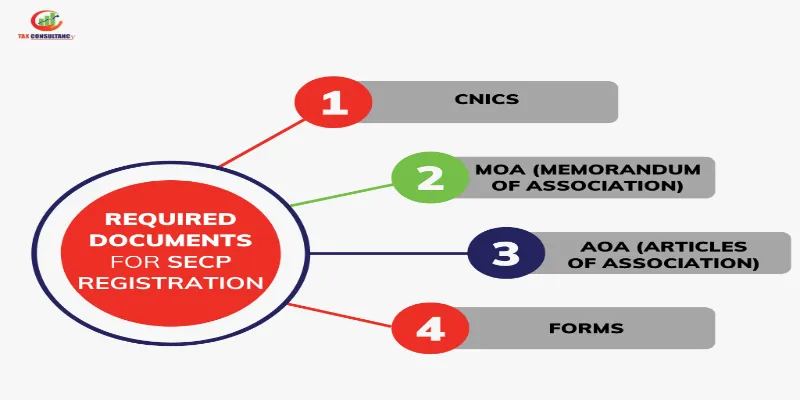

2. Required Documents

- CNICs: Copies of the National Identity Cards for all directors and shareholders.

- MOA (Memorandum of Association): Outlines the business’s charter, domain, and purpose.

- AOA (Articles of Association): Details the rules for the company’s internal management.

Forms: Completion and submission of Form 1, Form 21, and Form 29.

3. Registration Process

- Online Portal: Complete and submit the registration forms using the SECP’s eServices portal.

- Physical Office Visit: Alternatively, submit the forms at the nearest SECP office if preferred.

Importance of SECP Registration

- Registration gives your business a legal identity and formal recognition by the government.

- Official registration enhances trust among customers, partners, and potential investors.

- It ensures compliance with local laws and enables access to financial and support services offered to registered businesses.

Tax Registration (Mandatory)

Obtaining a National Tax Number (NTN) from Pakistan’s Federal Board of Revenue (FBR) is crucial for any software house, as it serves as your business’s tax identity, ensuring legal compliance and financial transparency. Holding an NTN verifies your legitimacy, enables legal business operations within Pakistan, and allows for potential tax credits and deductions. Software houses must regularly file tax returns, declaring their earnings and expenses, typically annually. Compliance with these tax obligations is essential for maintaining your business’s credibility and avoiding legal issues, ultimately supporting your enterprise’s operational and financial stability.

Registration With Pakistan Software Export Board (PSEB) (Optional)

The Pakistan Software Export Board (PSEB) is an essential government body that promotes and facilitates the IT industry in Pakistan. Registering with the PSEB can provide significant benefits for software houses looking to expand their domestic and international presence.

PSEB Registration Process

The Pakistan Software Export Board (PSEB) is an essential government body that promotes and facilitates the IT industry in Pakistan. Registering with the PSEB can provide significant benefits for software houses looking to expand their domestic and international presence.

1. Online Application

- Details Required: You must complete an online form providing details about your business, such as the services offered, number of employees, and business address.

2. Required Documents

- Business Documentation: Similar to the SECP registration, you must submit documents such as the CNICs of directors, Memorandum of Association (MOA), and Articles of Association (AOA).

- IT-Specific Documents: Additionally, focus on IT-specific documentation that demonstrates your business’s capabilities and projects in the IT industry.

The process is streamlined through PSEB’s online portal, making it accessible for all software houses aspiring to enhance their operational capabilities and market reach. Registering with PSEB, while optional, is a strategic move to leverage sector-specific benefits that could significantly boost your business’s growth and development in the tech industry.

Benefits Of PSEB Registration

- PSEB offers a variety of incentives for registered businesses, including tax exemptions and reduced rates on technology imports.

- Being part of the PSEB community provides access to a network of industry leaders and peers, facilitating partnerships and collaborative opportunities.

- PSEB provides valuable market insights and trends specific to the IT sector, helping your business stay competitive and informed about global opportunities.

Let’s Wrap It up!

Starting and registering a software house in Pakistan involves several crucial steps, from deciding on your business structure to obtaining necessary registrations with SECP and, optionally, the PSEB. Each step, from securing a National Tax Number (NTN) with the FBR to potentially registering with the Pakistan Software Export Board, plays a vital role in establishing your business legally and positioning it for success. Take the first step towards securing your business’s future in Pakistan’s booming IT industry. Visit our page at Khan & Co for more information or to schedule a personalised consultation. We are here to help you with each step, ensuring your journey to launching a successful software house is as smooth and efficient as possible. Don’t hesitate—start your registration process today and tap into the vast potential of the tech industry in Pakistan.