Online vehicle verification is a convenient and essential method to authenticate and confirm ownership details of a vehicle in Punjab, Pakistan. Utilizing the Punjab Government Excise and Tax Department website, this process safeguards against fraud and ensures informed vehicle purchases. The following guide by TaxConsultancy provides comprehensive insights:

Understanding Vehicle Verification: Vehicle verification is the process of confirming the authenticity and ownership details of a vehicle. It helps buyers ensure they are making a secure and informed purchase.

Importance of Vehicle Verification: Verifying a vehicle online is crucial as it prevents fraud, confirms ownership legitimacy, and ensures the vehicle’s legal status before purchase or transfer of ownership.

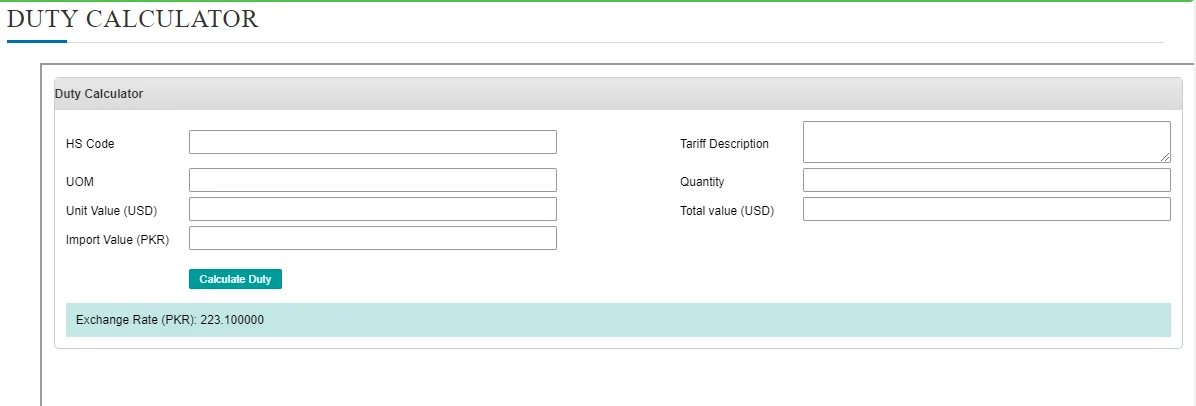

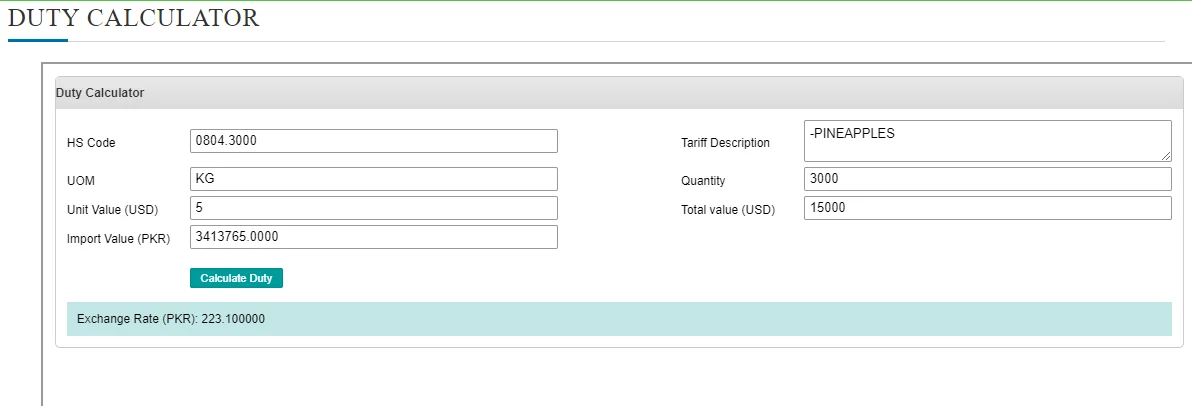

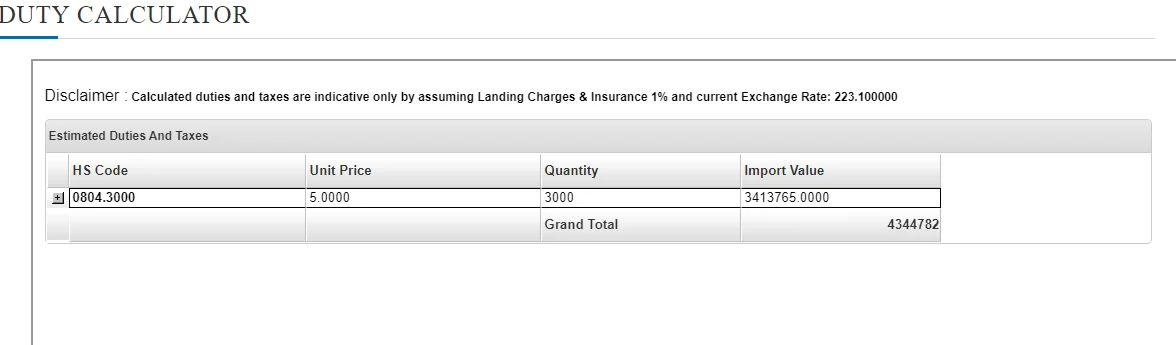

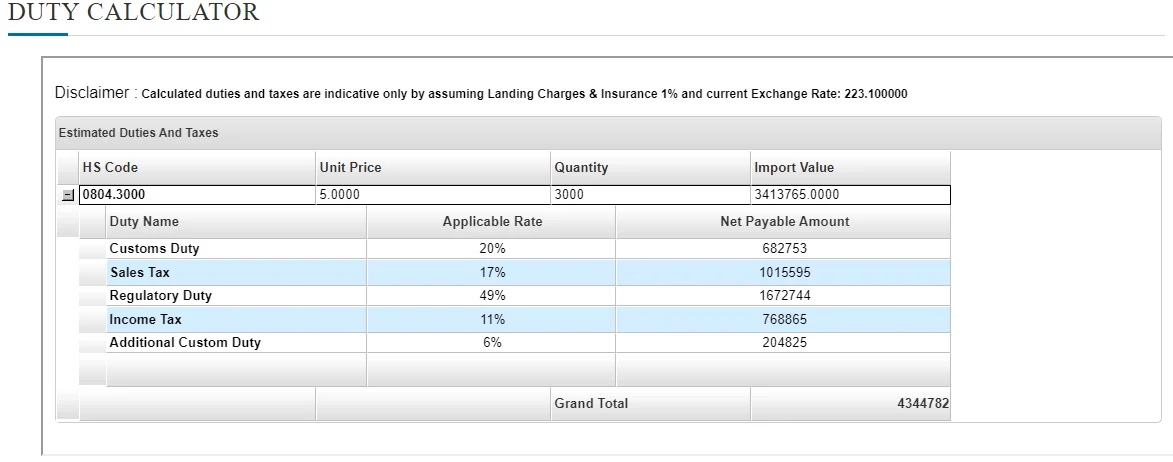

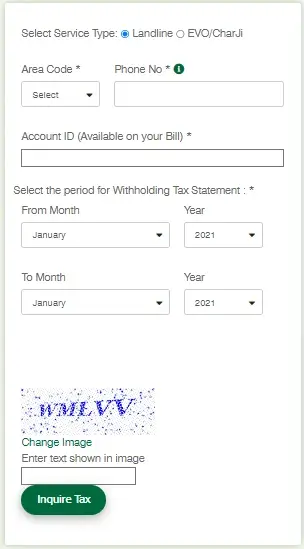

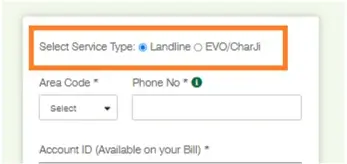

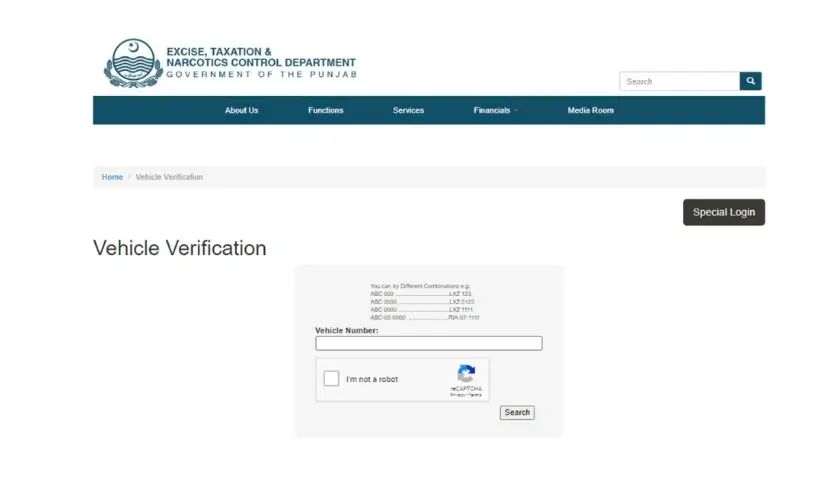

Step-by-Step Guide for Online Verification:

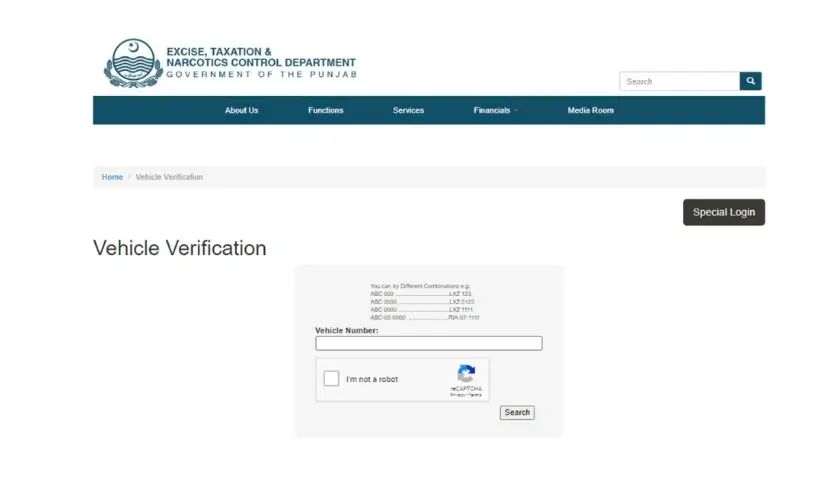

- Visit the Punjab Government Excise and Tax Department website.

- Navigate to the vehicle verification section.

- Enter the required details such as vehicle registration number.

- Submit the information to view the vehicle’s details and ownership status.

Benefits of Online Vehicle Verification through MTMIS Punjab:

- Convenience: Verify vehicles from anywhere, eliminating the need to visit physical locations.

- Accuracy: Access up-to-date information directly from government records.

- Fraud Prevention: Confirm vehicle authenticity and ownership to avoid scams.

- Legal Compliance: Ensure compliance with vehicle registration and ownership laws.

Online Vehicle Inspection Service and Registration in Punjab: The online vehicle verification service offered by MTMIS Punjab streamlines the process of checking vehicle details, promoting transparency and security in vehicle transactions. For a hassle-free experience and peace of mind, verify your vehicle online today!

Introduction To Vehicle Verification

What is Vehicle Verification?

Vehicle verification is the process of checking the authenticity and ownership of a vehicle. This can be done for a variety of reasons, such as when buying a used car, checking if a vehicle is stolen, or ensuring that a vehicle is registered and insured.

Why is it important?

Imagine buying a questionable used car or an illegal antique car. Nobody wants that, right? A car warranty helps protect consumers from such potential pitfalls, ensuring that the car you just bought has no bones in its boot

Prevent fraud: You can protect yourself from scams and fraud by checking before buying a car.

Avoid Buying Stolen Vehicles: Vehicle warranties can help you avoid buying stolen vehicles.

Make sure the vehicle is registered and insured : A vehicle warranty can help you ensure that the vehicle is registered and insured, which is required by law.

Check for outstanding titles or licences: A vehicle inspection can help you check for any missing titles or licences. It is important to know this before you buy a car as it can affect how you register and register the vehicle in your name.

Overall, vehicle warranty is an important step when buying a used car or inspecting the condition of the car. It can help you avoid fraud, protect against buying a stolen car, and ensure the vehicle is registered and insured.

The Step-by-Step Guide To Online Vehicle Verification In Punjab

The Registration Process

Starting your verification journey is as easy as pie! Imagine the feeling of the breeze on a sunny day – that’s how effortless it is. Here’s your quick guide:

Necessary Documents

Ah, the essentials! Just as a seasoned traveller wouldn’t forget their trusty map, when venturing into the realm of vehicle verification, there are a few must-haves. To ensure your journey is smooth and devoid of hitches, keep these vital documents close at hand. Here’s a neat table to guide you:

| Document | Description |

|---|

| Proof of Vehicle Ownership | Confirmation that the vehicle belongs to you. |

|---|

| National Identity Card (NIC) | A valid NIC showcasing your identity as the vehicle’s owner. |

|---|

| Recent Passport-sized Photograph | A recent snap to ensure there’s a face to the name. |

|---|

| Previous Vehicle Registration Details | If your vehicle had a past registration, those details are pivotal. |

|---|

Keep these by your side, and you’re all set to conquer the vehicle verification terrain with confidence and ease! Safe travels!

Online Platform Features

The online platform isn’t just about verification. It offers:

- Real-time status updates

- Digitalised record access

- Secure data protection protocols

Post-Verification Steps

Once verified, you’ll receive a confirmation. It’s advisable to print this out or save a digital copy. Remember, being verified isn’t a one-time thing. Regular checks, especially after transactions involving the vehicle, are always a good practice.

Benefits Of Online Vehicle Verification Through MTMIS Punjab

The digital age has truly blessed us, hasn’t it? While the compass leads the navigator, the MTMIS-Punjab platform is our North Star in vehicle certification. Then why should you, my friend, embark on this digital journey? Let’s break that down, simple story by story:

- Quick and easy: No more jumping from one office to another! With a few clicks, you’re already sailing in the process.

- Safety first: You get peace of mind that there are no hidden issues or complications with the car you are considering.

- Open Always: Whether you are an early bird or a night owl, MTMIS Punjab is there for you, round the clock.

- It saves you money: Think of all the fuel and transportation costs you saved by not having to go to the office. Plus, it doesn’t get any more tiring than that look-shopping!

- Green footprint: When you go digital, you are doing some of your work for the environment. A few letters indicate that fewer trees are harvested.

- All vehicles, one platform: From zippy bikes to big trucks, if you are on Punjab roads, you know about MTMIS.

- No More Guesswork: Every piece of information you find is accurate, letting you know that you always know.

So, whether you are buying, selling, or just curious, MTMIS Punjab is your trusted partner to ensure your traffic is smooth, informed and enjoyable. Are you ready to dive in?

How Do I Contact Punjab Vehicle Verification?

Ever feel like you’re embarking on a journey, but worry about getting lost? Well, across the sprawling lands of Punjab, we have mapped out the important stops on your verification journey. Use this table as your compass, and it points you in the right direction.

| City | Address | Contact Number | Email | Office Hours |

|---|

| Lahore | Government of the Punjab, 2nd Floor, Transport House, 11-Egerton Road | 0800-08786 | secyent@punjab.gov.pk | Mon-Fri, 11:00 AM to 4:00 PM |

| Rawalpindi | 22-A, Civil Lines | 051-9271926 | detrwp@punjab.gov.pk | Standard Office Hours |

| Faisalabad | P/819, behind Serena Hotel, near Jinnah Garden | 041-9200023 | detfsd@punjab.gov.pk | Standard Office Hours |

| Multan | Lodhi Colony Road, MDA Chowk | 061-9200123 | detmn@punjab.gov.pk | Standard Office Hours |

| Sargodha | Mela Mandi Road | 048-9230190 | detsgh@punjab.gov.pk | Standard Office Hours |

| D.G. Khan | Railway Road | 064-9260186 | detdgk@punjab.gov.pk | Standard Office Hours |

| Gujranwala | District Courts | 055-92 00 431 | detgw@punjab.gov.pk | Standard Office Hours |

| Bahawalpur | Near Civil Court | 062 – 92 50 173 | detbwp@punjab.gov.pk | Standard Office Hours |

| Sahiwal | Fateh Sher Road | 040-9200198 | det.swl@punjab.gov.pk | Standard Office Hours |

Remember, every adventure is unique, and while this table guides you to the destination, the journey itself will have its own stories. Happy verifying!

Lets Rape It Up!

The online vehicle verification system in Punjab is not just a bureaucratic step but a revolutionary stride towards safer and more secure roads. By ensuring every vehicle’s legitimacy, Punjab is paving the way for a brighter, safer future for all its citizens. So the next time you think of buying a vehicle in Punjab, remember the power of verification. After all, it’s always better to be safe than sorry.

Other Details!

What information is available through online vehicle verification?

The following information is available through online vehicle verification in Punjab:

- Vehicle registration number

- Make and model of the vehicle

- Colour of the vehicle

- Chassis number of the vehicle

- Engine number of the vehicle

- Name of the vehicle owner

- Date of registration of the vehicle

- Token tax paid up to

- Any liens against the vehicle

What if I don’t have my vehicle’s registration number?

If you don’t have your vehicle’s registration number, you can use the vehicle’s chassis number or engine number to verify it online.

What if I find out that my vehicle has been stolen or has liens against it?

If you find out that your vehicle has been stolen or has liens against it, you should contact the police or the Excise & Taxation Department, Government of Punjab immediately.

Is online vehicle verification the same as vehicle inspection?

No, online vehicle verification is not the same as vehicle inspection. Online vehicle verification checks the authenticity and ownership of a vehicle, while vehicle inspection checks the safety and condition of a vehicle.

Can I use online vehicle verification to transfer ownership of a vehicle?

No, you cannot use online vehicle verification to transfer ownership of a vehicle. To transfer ownership of a vehicle, you must visit the Excise & Taxation Department, Government of Punjab office.